The Importance of Child Insurance Policies in Financial Planning

When we focus on securing our family’s financial future, we often overlook the importance of securing the future of our children. While we diligently invest in our retirement, group insurance plans, and term plans, we sometimes neglect our children, who are our most precious assets. This is where a child insurance policy steps in, shielding against the uncertainties of life and ensuring a stable foundation for our young ones.

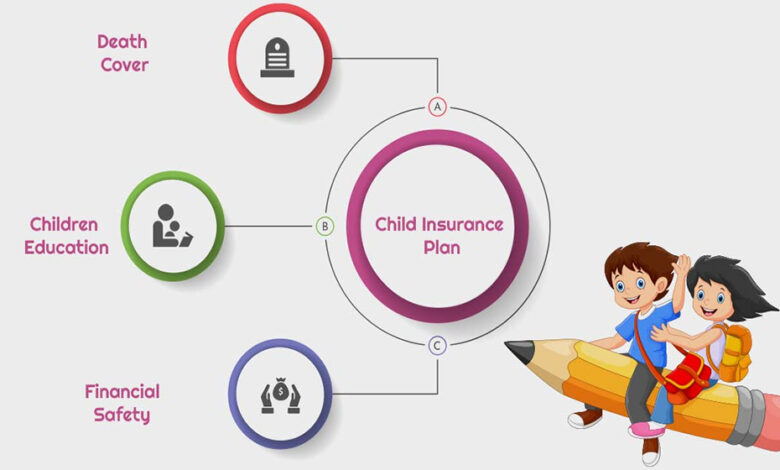

Child insurance policies are not just about providing financial assistance in case of unfortunate events; they are about securing a child’s future in the face of any eventuality. Here’s why they are indispensable in any comprehensive financial plan:

- Protecting Against the Unforeseen

Life is unpredictable, and tragedies can strike at any moment. A child insurance policy acts as a safety net, providing a lump sum amount or regular payouts to cover expenses such as education, healthcare, and other needs, should the parent(s) pass away prematurely. This ensures that the child’s aspirations are not compromised due to financial constraints.

- Ensuring Access to Quality Education

A child’s future success is largely dependent on their education. However, the rising costs of tuition fees and other educational expenses can pose a significant challenge for parents. Child insurance policies can be tailored to accumulate a corpus over the policy term, which can then be utilized to fund the child’s education at key milestones of their academic journey, whether it’s primary school, college, or beyond.

- Building Financial Discipline and Responsibility

Introducing children to the concept of insurance early on instills in them a sense of financial discipline and responsibility. By witnessing their parents’ proactive approach towards securing their future, children are more likely to develop healthy financial habits themselves. Moreover, some child insurance policies come with options for the child to take over the policy once they reach adulthood, empowering them to continue the legacy of financial prudence.

- Mitigating Risks and Uncertainties

Child insurance policies not only provide financial protection in the event of the parent’s demise but also offer riders or add-on benefits that cover critical illnesses or disabilities. These riders ensure that the child receives necessary medical care and support without imposing a financial burden on the family during challenging times. Additionally, some policies offer waiver of premium benefits, ensuring that the policy remains active even if the parent is unable to pay due to disability or illness.

- Securing Long-Term Financial Goals

Beyond immediate needs, child insurance policies play a crucial role in securing long-term financial goals such as marriage, homeownership, or entrepreneurship for the child. By investing in a child insurance policy early, parents can utilize the power of compounding to accumulate a substantial corpus over time, which can then be utilized to fulfill the child’s aspirations and dreams, irrespective of market fluctuations or economic downturns.

Child insurance policies are not just another financial instrument; they are a testament to a parent’s unwavering commitment to securing their child’s future. By incorporating child insurance policies into their financial planning, parents can rest assured knowing that they have taken proactive steps to safeguard their children against life’s uncertainties and provide them with the best possible start in life. After all, investing in our children today ensures a brighter and more secure tomorrow for generations to come!