Finance

-

How to Use a Stock Scanner to Detect Market Reversals

Stocks screener tools play a crucial role in identifying trading opportunities, and one of their most valuable uses is detecting market reversals. A well-configured stocks screener can help traders spot changes in trends before they fully develop, allowing for better entry and exit strategies. Additionally, combining these insights with a calculator for CAGR (Compound Annual Growth Rate) can help investors…

Read More » -

Understanding Nominee Director and Shareholder Services for Singapore Companies

Introduction In the dynamic business view of Singapore, establishing a company includes navigating a myriad of legal and administrative requirements. Among these, the acts of nominee directors and shareholders are important, especially for foreign executives and investors. This article delves into the significance of nominee directors and shareholder services, elucidating their roles, benefits, and allowable implications for Singapore associations. The…

Read More » -

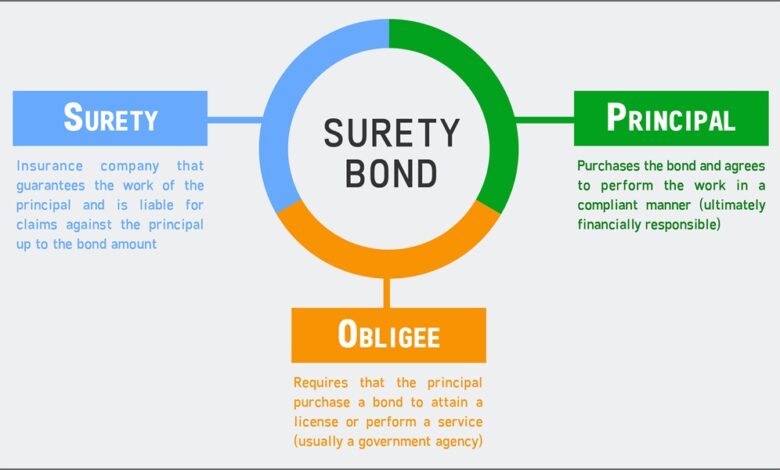

The Role of Surety Bonds in Construction Insurance

Construction surety bonds help secure project completion and protect stakeholders from financial damages. Construction is dangerous due to complicated relationships between owners, contractors, subcontractors, and suppliers. Unexpected issues like cost overruns, delays, and defaults increase uncertainty. Surety bonds provide stability, responsibility, and risk minimization. This article discusses surety bonds in construction insurance, their advantages to all parties, and their influence…

Read More » -

Common Mistakes to Avoid When Applying for a Bank Account

Opening a bank account is one of the first steps toward financial independence and security. Whether you’re looking to open your very first account or expand your financial options, it’s essential to approach the process carefully. Banks like IDFC FIRST Bank offer convenient, feature-rich account options, but you must avoid common mistakes to ensure a smooth application process. Here are…

Read More » -

How to Open a Salary Account Online: A Step-by-Step Guide

It is easy to open a salary account online in India. The whole process is quick, convenient, and paperless. Online salary account opening procedures can save you from the hassles of visiting a bank branch. This article will help you explore the easy-to-understand steps to open a salary account online. Open a Salary Account in 7 Easy Steps You can…

Read More » -

Balancing Risk and Reward: Choosing Yield Strategies Wisely in DeFi

As decentralized finance (DeFi) continues to evolve, it has become an attractive option for investors looking to earn passive income with complete control over their funds. On EVM-enabled blockchains, DeFi offers a range of yield options that vary in both risk and reward. Choosing the right yield strategy involves understanding your risk tolerance and knowing the protocols that best match…

Read More » -

A Guide to How IPO Allotment Works for Investors

Understanding how IPO allotment works is essential for anyone looking to invest in the stock market. An Initial Public Offering (IPO) is when a private company offers its shares to the public for the first time. This process can be exciting but also a bit complex, especially when it comes to how shares are allocated to investors. This guide will…

Read More » -

The Benefits of Having a Guarantor for Your Mortgage

When navigating the complexities of securing a mortgage, having a guarantor for your mortgage can be a game-changer. But what exactly does a guarantor do, and why might you consider enlisting one? Let’s explore how this arrangement can benefit both borrowers and lenders. What is a Mortgage Guarantor? A mortgage guarantor is someone who agrees to take responsibility for the mortgage…

Read More » -

Top Ethereum Staking Platforms for Beginners: What You Need to Know

Staking has been a common approach for investors to get passive income as Ethereum moves to a proof-of-stake (PoS) consensus mechanism. Staking lets users lock down their Ether (ETH) to help the network run while getting paid back. However, with so many platforms available, newcomers may find it difficult to decide which one is among the best ethereum staking platforms…

Read More » -

The Rise And Rise Of The Family Office: An Analysis

In recent years, the concept of the family office has been gaining momentum in the financial world. What was once a niche service for ultra-high-net-worth individuals has now become a significant player in the wealth management industry. This article will delve into the reasons behind the rise of family offices and analyze their impact on the financial landscape. Understanding Family…

Read More »