The Role of Surety Bonds in Construction Insurance

Construction surety bonds help secure project completion and protect stakeholders from financial damages. Construction is dangerous due to complicated relationships between owners, contractors, subcontractors, and suppliers. Unexpected issues like cost overruns, delays, and defaults increase uncertainty. Surety bonds provide stability, responsibility, and risk minimization. This article discusses surety bonds in construction insurance, their advantages to all parties, and their influence on the construction ecosystem.

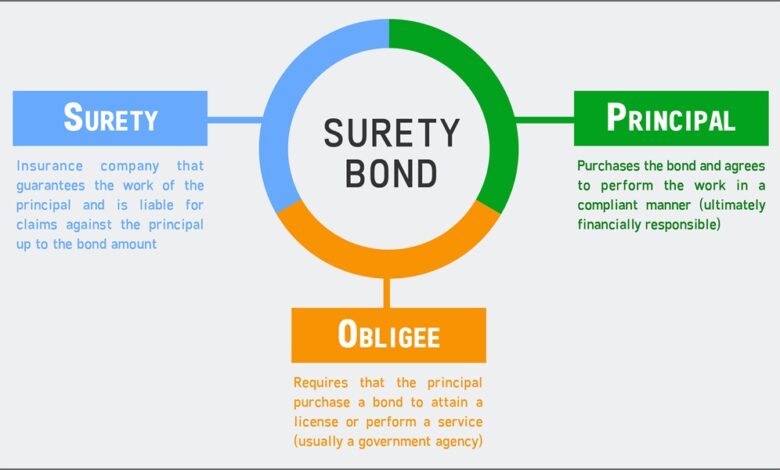

Understanding Surety Bond Basics

Instead of insurance, surety bonds are a three-party arrangement between the project owner (obligee), contractor (principal), and surety business. The surety firm assures the project owner that the contractor will perform as promised. If the contractor fails to deliver due to bankruptcy, unfinished work, or other reasons, the surety bond covers financial losses or finds a new contractor. Construction surety bonds vary. Most commonly, bid bonds guarantee the contractor will honor their bid if awarded the project, performance bonds guarantee the contractor will complete the project as specified, and payment bonds guarantee subcontractors, suppliers, and workers are paid for their services and materials. These bonds provide complete protection during a building project.

Accountability for Project Completion

Surety bonds keep contractors responsible and assure construction project completion. Project owners require confidence that a contractor will complete work as planned after bidding and winning. Performance bonds legally protect project owners against contractor failure. Contractors are motivated to comply with contracts by this accountability.

If default occurs, the surety firm takes action. This may entail penalties to the project owner, funding completion, or hiring a new contractor. This reduces interruptions and financial costs from unfinished projects. This predictability gives project owners confidence in their investments. Without surety bonds, owners risk delays, unforeseen expenditures, and abandoned projects.

Insurance against financial loss

Surety bonds affect construction at numerous levels financially. Surety bonds’ financial assurance may make or break a project for owners. Payment bonds ensure workers, subcontractors, and suppliers be paid for their labor and supplies, protecting property owners and other stakeholders. Without these safeguards, a struggling contractor may leave millions of dollars in unpaid bills, sparking lawsuits or liens. Choosing the right construction insurance is important here.

Contractors need surety bonds too. Contractor bonds do not provide insurance, but they do open doors to bigger, more lucrative contracts. High-value governmental and commercial projects typically need performance and payment bonds. Before providing a bond, bonding firms thoroughly evaluate the contractor’s financial soundness, work history, and skills. This due diligence approach boosts a contractor’s reputation and reliability with new customers, protecting all parties.

Long-term sustainability and risk management

Comprehensive construction risk management fits surety bonds. Construction projects face weather delays, labor shortages, contract conflicts, and economic changes. Insurance, loss control, and industry-specific measures like surety bonds are needed to mitigate these risks. Surety bonds bridge gaps in CGL, Builder’s Risk, and Commercial Property Insurance caused by contractor defaults.